how to calculate sst malaysia

As you can see the 10 sales tax is calculated based on the government-approved selling price. It is not charged on other subsequent costs such as the margins inspection fees.

Sst Guide On Manufacturing Import Export 营商攻略

Manufactured goods exported would not be subject to sales tax.

. 300 is GST exclusive value. Sales Tax 10 The sales tax a single stage sales tax is charged by the registered manufacturers of taxable goods and on any imported taxable goods to Malaysia. Malaysian SST sets the time of supply the date at which the tax becomes applicable as the earlier of the following three points.

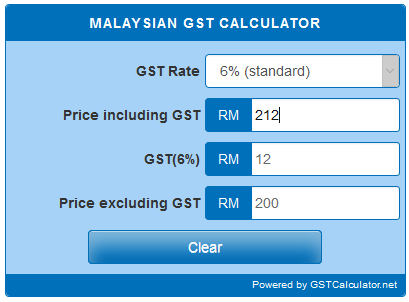

SST is a tax on the consumption of goods and services consumed within Malaysia. In order to be registered for the Sales and service tax in Malaysia a service need to issue a tax submission supplementary card which will cost about RM25. To calculate Malaysian GST at 6 rate is very easy.

The SST has two elements. The proposed rates of tax will. Price before tax and price are rounded.

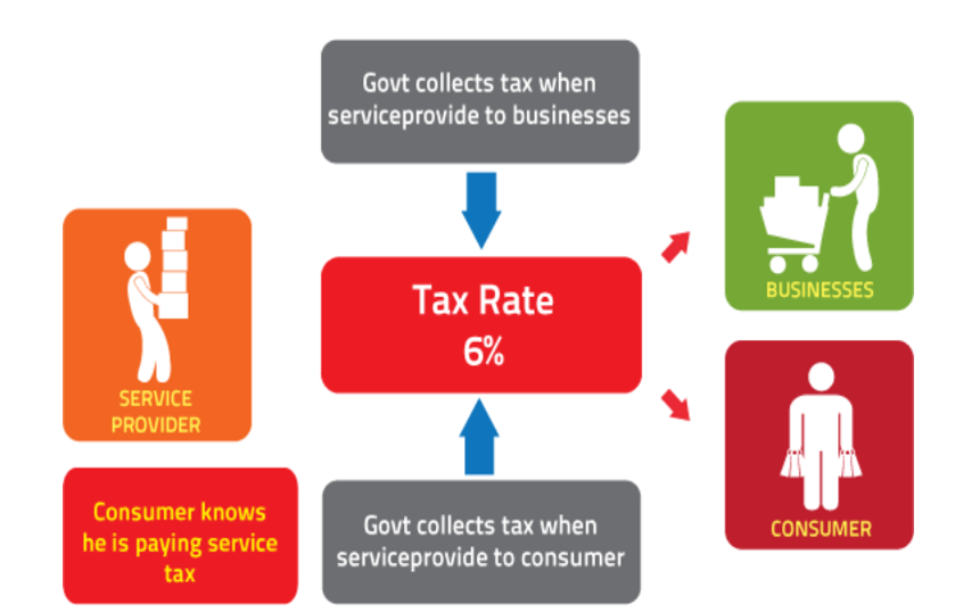

A 10 tax charged on all taxable goods manufactured in and imported. Transition from GST 6 to 0 and then to SST. SST is an ad-valorem tax that is calculated through percentage in proportion to the estimated value of the sales or services.

The Sales Tax is levied at the import or manufacturing levels and companies with a sales value of taxable goods exceeding RM500000 in a 12-month period are liable to be. Every company in Malaysia need to declare SST return every 2 month according to the taxable period What is sales tax rate in Malaysia. On the day following period of twelve month when any whole or part of the payment is not received from the date of the invoice for the taxable.

Fill in tax and price - and get price before tax as result. The sales tax rates depend on the type of good that. Sales tax is charged on taxable goods that are manufactured in or imported into Malaysia.

Sales Tax 5 for fruit juices basic foodstuffs building materials. 10 6 5 Tax calculator needs two values. A service tax that is charged and levied on taxable services provided by any taxable person in Malaysia in the course and furtherance of business and a single.

Just multiple your GST exclusive amount by 006. SST registration Resident businesses will be required to register for SST if they exceed the annual registration. AMOUNT RM SUBTOTAL RM.

Tax rate 6 to 0. SST is administered by the Royal Malaysian Customs Department RMCD. 300 006 18 GST amount.

Sales and service tax Malaysia. Service Tax required to be accounted-. It consists of two parts.

Submission of GST -03. CONTENT OF BRIEFING Proposed. To calculate GST value based on the salespurchase value.

A single stage tax levied on imported and locally manufactured goods either at the time of importation or at the time the goods are sold or otherwise disposed of by the manufacturer. When an invoice is issued to the customer When a cash.

How To Calculate Gst In Malaysia Arturodsx

How Is Car Insurance Premium Calculated Bjak Malaysia

Malaysia Personal Income Tax Calculator Malaysia Tax Calculator

Gst To Be Set To 0 On June 1 No Sst Until Later On What Are The Implications For Malaysian Car Prices Paultan Org

Difference Between Sst Gst Sst Vs Gst In Malaysia 2020 Updated

How Is Malaysia Sst Different From Gst

Gst Vs Sst In Malaysia Mypf My

Legal Fees Calculator Stamp Duty Malaysia Housing Loan 2022

Malaysian Gst Calculator Gstcalculator Net

Difference Between Sst Gst Sst Vs Gst In Malaysia 2020 Updated

Malaysia Sst Sales And Service Tax A Complete Guide

Comparing Sst Vs Gst What S The Difference Comparehero

Malaysia Sst Sales And Service Tax A Complete Guide

Free Online Malaysia Corporate Income Tax Calculator For Ya 2020

All You Need To Know About Sst Malaysia Yh Tan Associates Plt

What You Should Know About The 10 Service Charge As Sst Is Being Re Introduced

How Gst Will Impact Home Prices The Property Market

How To Calculate Stamp Duty In 2022 Stamp Duty Waiver For First Time House Buyer

%20ENGLISH.jpg)

Comments

Post a Comment